are rolex watches tax deductible | write off 10k Rolex are rolex watches tax deductible While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find yourself in tax court to learn the hard way that you can't write off just anything. A party of four or five PCs at level 2 or 3 can probably take it out. Especially if they have a big raging barbarian to soak up damage while a rogue sneak-attacks from range - they're going to kill it fast.

0 · write off 10k Rolex

1 · roman sharf watches tax write off

2 · are luxury watches tax write off

Ģimenes portāls Cālis.lv - viss par bērniem un ģimeni. Vecāku un ekspertu pieredze un padomi, aktuālākie jaunumi.

While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find . While it may be bad news to find your Rolex isn't deductible, it's better to .

While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find . While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find yourself in tax court to learn the hard way that you can't write off just anything. Is a luxury watch a tax write off? In other words, can you deduct a luxury watch purchase as a business expense? Grey market watch dealer Roman Sharf of Luxury Bazaar made a video answering the question, but is he right or wrong? It seems somewhat reasonable. First and foremost, you have to remember—the IRS requires that for an expense to be deductible, it must be both "ordinary and necessary" for your business.

The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one .

It seems somewhat reasonable. You hear about company’s gifting watches to key employees after hitting employment milestones. How does this work with regards to taxes and what can you actually do.

Despite popular belief and advice from some tax professionals and influencers, the IRS and tax courts generally do not allow deductions for Rolexes. The deductibility of clothing and accessories hinges on three criteria: being required or essential for .Can you invest in Rolex? Absolutely, Rolex watches are viewed as a dependable asset because of their consistent track record in maintaining and potentially appreciating value over the years. One should give thought to acquiring both contemporary and vintage models. Is a Luxury Watch a Tax Write Off? New Grey Market Episode: "My Plan to CRUSH 0 Million in Sales in 2024" • Client Buys His First Rolex Watch -~- Can you write off a Rolex? Find out in.

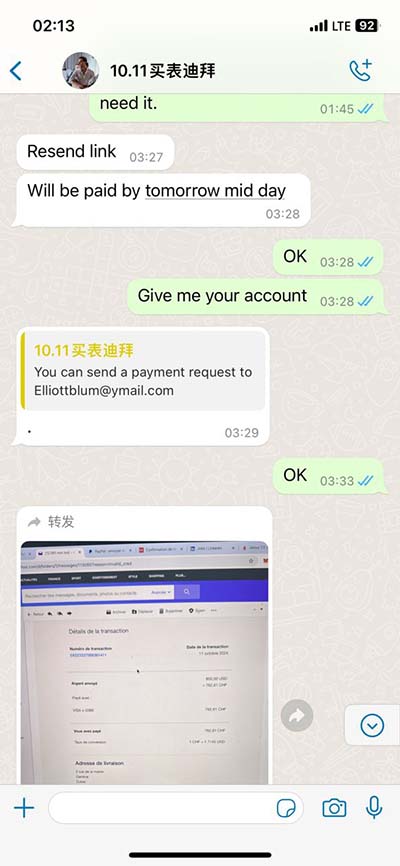

Wire transfers over k (because they are treated like cash) are reported to the IRS. Only cash transactions are reported on a CTR “Currency Transaction Report” or Form .While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find .

While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find yourself in tax court to learn the hard way that you can't write off just anything.

Is a luxury watch a tax write off? In other words, can you deduct a luxury watch purchase as a business expense? Grey market watch dealer Roman Sharf of Luxury Bazaar made a video answering the question, but is he right or wrong? It seems somewhat reasonable. First and foremost, you have to remember—the IRS requires that for an expense to be deductible, it must be both "ordinary and necessary" for your business.

The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one .It seems somewhat reasonable. You hear about company’s gifting watches to key employees after hitting employment milestones. How does this work with regards to taxes and what can you actually do.

Despite popular belief and advice from some tax professionals and influencers, the IRS and tax courts generally do not allow deductions for Rolexes. The deductibility of clothing and accessories hinges on three criteria: being required or essential for .Can you invest in Rolex? Absolutely, Rolex watches are viewed as a dependable asset because of their consistent track record in maintaining and potentially appreciating value over the years. One should give thought to acquiring both contemporary and vintage models.

write off 10k Rolex

Is a Luxury Watch a Tax Write Off? New Grey Market Episode: "My Plan to CRUSH 0 Million in Sales in 2024" • Client Buys His First Rolex Watch -~- Can you write off a Rolex? Find out in.

burberry brit belted down jacket with genuine fox fur collar

burberry brit cape olive

Once it has reached level 99, an enhanceable spirit can be enhanced, transforming it into a higher-class spirit; typically, the enhanced spirit's trait is not normally available to primary spirits. The enhanced spirit reverts to level 1 after being enhanced.

are rolex watches tax deductible|write off 10k Rolex